5 Easy Facts About Atlanta Hard Money Lenders Described

Wiki Article

The Single Strategy To Use For Atlanta Hard Money Lenders

Table of ContentsThe Basic Principles Of Atlanta Hard Money Lenders Little Known Facts About Atlanta Hard Money Lenders.Some Known Details About Atlanta Hard Money Lenders What Does Atlanta Hard Money Lenders Mean?Atlanta Hard Money Lenders for DummiesThe 9-Minute Rule for Atlanta Hard Money Lenders

In most cases the approval for the difficult money loan can occur in just eventually. The tough money lending institution is going to consider the home, the amount of deposit or equity the borrower will have in the building, the customer's experience (if appropriate), the leave approach for the building and make certain the customer has some cash gets in order to make the regular monthly lending settlements.Investor that haven't formerly made use of tough money will be impressed at just how rapidly tough money lendings are funded compared to financial institutions. Contrast that with 30+ days it considers a bank to fund. This fast funding has actually conserved countless actual estate investors that have actually remained in escrow just to have their original lending institution pull out or merely not provide.

Their checklist of requirements increases annually and also much of them seem approximate. Banks also have a list of problems that will certainly raise a warning as well as prevent them from even thinking about offering to a borrower such as recent foreclosures, short sales, loan alterations, as well as bankruptcies. Poor credit report is one more variable that will prevent a financial institution from offering to a debtor.

The Ultimate Guide To Atlanta Hard Money Lenders

Fortunately genuine estate investors that might currently have several of these problems on their record, hard money lenders are still able to provide to them. The difficult money loan providers can offer to borrowers with problems as long as the customer has sufficient down payment or equity (at the very least 25-30%) in the property.In the situation of a potential consumer that wishes to acquire a key home with an owner-occupied difficult money financing through a private mortgage loan provider, the debtor can originally buy a property with hard money and after that function to fix any kind of issues or wait the essential amount of time to get rid of the problems.

Banks are additionally reluctant to provide mortgage to debtors who are self-employed or presently do not have the required 2 years of employment background at their present position. The debtors may be an excellent prospect for the financing in every other aspect, but these approximate requirements avoid banks from expanding funding to the debtors.

8 Simple Techniques For Atlanta Hard Money Lenders

In the situation of the debtor without adequate employment background, they would be able to re-finance out of the hard cash finance and into a reduced price standard funding once they got the essential 2 years at their present position. Hard cash loan providers provide numerous finances that conventional lending institutions such as banks have no passion in financing.

These jobs include an investor buying a home with a short-term financing to make sure that the investor can promptly make the required repairs as well as updates and after that market the property. atlanta hard money lenders. In many cases, the genuine estate capitalist only requires a twelve month finance. Banks desire to lend money for the long-term and also enjoy to make a small quantity of interest over a lengthy duration of time.

The problems might be connected to foundation, electrical or pipes and could trigger the bank to take into consideration the home uninhabitable and also incapable to be moneyed. and also are incapable to take into consideration a car loan circumstance that is beyond their strict loaning standards. A tough cash lending institution would certainly be able to give a customer with a car loan to acquire a property that has issues preventing it from getting a traditional small business loan.

The Definitive Guide to Atlanta Hard Money Lenders

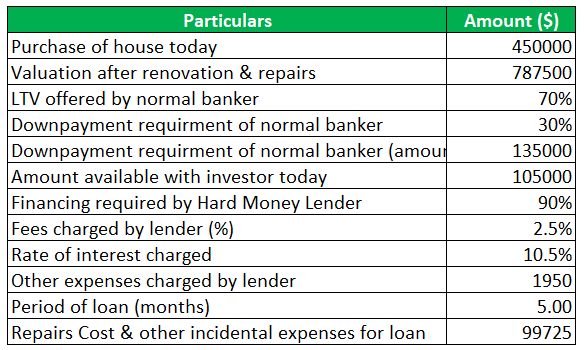

Difficult cash loan providers additionally charge a lending origination charge which are called factors, a percentage of the finance amount. atlanta hard money lenders. Points usually range from 2-4 although there are lending institutions who will certainly charge a lot higher points for certain situations. Particular locations of the nation have several contending hard money loan providers while other areas have few.

In large cities there are usually several even more difficult cash lenders happy to lend than in even more remote country areas. Customers can profit significantly from inspecting prices at a couple of various lenders prior to dedicating to a tough money lending institution. While not all difficult cash lenders offer 2nd home loans or trust actions on residential properties, link the ones that do charge a greater rate of interest price on 2nds than on 1sts.

9 Easy Facts About Atlanta Hard Money Lenders Explained

This enhanced rate of interest price reflects the increased risk for the lender being in 2nd position rather than 1st. If the customer goes right into default, the first lien owner can confiscate on the residential or commercial property as well as erase the 2nd lien owner's passion in the property. Longer regards to 3-5 years are readily available but that is typically the ceiling for financing term length.If passion rates go down, the consumer has the choice of refinancing to the lower current rates. If the rates of interest boost, the debtor has the ability to maintain their lower rates of interest car loan and loan provider is compelled to wait up until the lending becomes due. you can find out more While the lender is awaiting the lending to end up being due, their investment in the trust fund deed is producing less than what they could receive for a brand-new depend on deed financial investment at existing rates.

Indicators on Atlanta Hard Money Lenders You Should Know

This is a worst situation situation for the difficult cash lending institution. In a comparable circumstance where the consumer places in a 30% down repayment (rather of only 5%), a 10% decline in the value find out here of the residential or commercial property still gives the customer lots of incentive to stick with the residential property and also task to safeguard their equity.Report this wiki page